A climate of kickbacks and revolving doors.

Washington’s revolving door is getting a fresh green paint job: Federal architects of a controversial new rule requiring businesses to measure their carbon footprints throughout their supply chains have joined a start-up company poised to reap millions by performing those calculations.

At least three ranking Securities and Exchange Commission officials have joined Persefoni, a company formed in 2020 for the purpose of measuring such footprints of large business enterprises.

Documents show that the SEC relied on input from the for-profit company to draft the proposed rule. Some critics argue that the estimates from Persefoni low-balled the price tags unrealistically for such accounting to make them more politically palatable.

Persefoni, billing itself as “The Platform for Carbon Accounting – Built For Climate Disclosure,” and similar outfits are emerging as their own service industry as they stand to profit from the new rule, since most companies do not have the staff or expertise to calculate their carbon footprints.

The report centers around potential corruption surrounding the SEC’s proposed carbon footprint rule. According to RCI, one Democrat SEC commissioner appointed the agency’s chair by Joe Biden named Allison Lee stepped down from the agency before the proposed rule was to be made public only to join Persefoni and serve on its sustainability advisory board.

Ironically enough, Lee ends up in the same company where former SEC staff attorney, Kristina Wyatt serves on Persefoni’s board of directors. RCI also reports the SEC conveniently relied heavily on Persefoni’s cost benefit analysis as the basis for the pending climate disclosure rule. As it turns out, Wyatt aided in developing the climate disclosure rule prior to taking a job at Persefoni.

RCI also reveals the complexity involved in companies complying with it:

The SEC proposal has many parts, but the most controversial and cumbersome involves the requirement that larger companies must provide soup-to-nuts calculations of their carbon emissions, including those from thousands of their suppliers operating across hundreds of countries.

As RealClearInvestigations has previously reported, to come up with numbers for Cocoa Puffs cereal, General Mills might have to calculate the emissions from “cocoa farms in Africa, corn fields in the U.S., or sugar plantations in Latin America. Then thousands of processors, transporters, packagers, distributors, office workers, and retailers join the supply chain before a kid in Minnesota, where General Mills is based, pours the cereal into a bowl.”

Since most of the emissions that must be measured are not directly generated by the companies, the calculations amount to a herculean task. This is where an outfit like Persefoni comes in.

So the SEC implements a new, cumbersome climate disclosure rule based on the cost benefit analysis of a 3 year old company that just so happens to be in the business of measuring corporate carbon footprints. Then companies affected by it hire Persefoni to aid them in complying with it. All of this brought to you by the revolving door of the SEC and Persefoni who who hire one another’s employees.

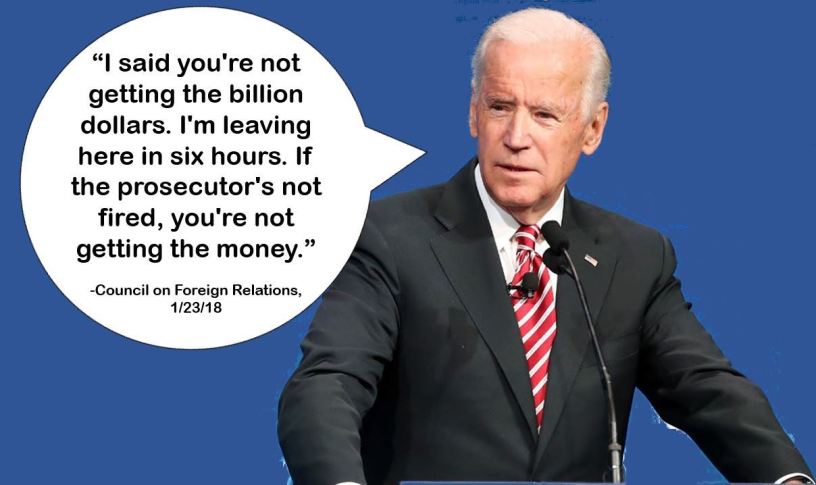

This is all very reminiscent of the reported collusion between the EPA and the Natural Resources Defense Council during the Obama Administration. Obviously, the folks at Persefoni and the SEC in question learned a thing or two about quid pro quo from the Big Guy. One wonders if he gets his 10% in all of this. Maybe the environmentalist groups that support this new requirement will get a piece of the action?